Crypto market’s weekly winners and losers – AAVE, LINK, WIF, BONK

- Virtuals Protocol, Aave, and Chainlink were the biggest winners in the past week.

- Dogwifhat, Brett, and Bonk led from the other end of the table as the biggest losers.

This week saw Virtual Protocol [VIRTUAL] emerge as the top-performing asset, gaining 39.80%, while Aave [AAVE] and Chainlink [LINK] also delivered impressive returns.

However, the week wasn’t without its losers, with memecoins topping the chart and facing notable declines.

Biggest winners

Virtual Protocol [VIRTUAL]

Virtual Protocol emerged as the top-performing asset last week, recording a 39.80% increase, according to data from CoinMarketCap. It started the week positively, rising by 2.65% to trade around $1.70.

The uptrend gained momentum between the 11th and the 13th of December, where sharp buying pressure pushed the price to a peak of $2.45.

This rapid surge reflected strong market sentiment and bullish activity, further supported by the growing trading volume.

By week’s end, the price stabilized around $2.45 despite experiencing a minor 0.19% decline, which signals a brief profit-taking phase.

The consistent increase in volume highlights sustained investor interest. Its volume has declined by over 32% as of this writing and is now around $205 million.

Aave [AAVE]

AAVE emerged as the second-highest gainer of the past week, posting an impressive 29.49% increase. The asset started the week with a modest upward move, trading around $282.85, reflecting early signs of bullish momentum.

AAVE’s price action reached a turning point on the 12th of December, with a sharp 21.20% surge that propelled its value to a weekly high of $367.10, driven by strong market demand and rising trading volumes.

Despite the strong performance, AAVE experienced minor selling pressure towards the end of the week, settling at $365.49 after a 3.24% decline.

The price correction suggests some profit-taking but remains within an overall bullish structure. If AAVE holds above $360, it could attempt to retest its recent high, with $340 as the critical support level to watch.

Chainlink [LINK]

Chainlink [LINK] emerged as the third-highest gainer of the past week, recording a 12.66% increase despite significant price fluctuations.

It kicked off the week with a 5.23% gain, trading around $26.10, signaling early bullish sentiment. However, the price faced a sharp downturn the following day, dropping by 14.57% to a weekly low of approximately $22.

This correction reflected profit-taking pressure but failed to dampen the overall bullish outlook.

The major turning point occurred on the 12th of December, when LINK saw an impressive 21.12% spike, catapulting its price to $29.00.

This sharp recovery was accompanied by a surge in trading volume, indicating renewed investor confidence and momentum.

By the end of the week, LINK stabilized at $29.11, registering a slight gain and solidifying its position as one of the top-performing assets.

From a technical perspective, LINK remains above its 50-day moving average, acting as a key support level.

The Relative Strength Index (RSI) hovered around 69, nearing overbought territory, suggesting cautious optimism for continued gains.

The upward trajectory of the 20-day Bollinger Bands reflects sustained volatility with room for further upside.

If bulls maintain momentum, Chainlink could target the $30 psychological resistance, with the $28 level as immediate support.

A decisive move above $30 could open doors to further gains, while failure to hold support may trigger a minor pullback.

Top 1,000 gainers

Outside the top 100, this week’s top gainer, Black Agnus [FTW], surged by over 4,318%. The second and third-largest gainers were Solvex Network [SOLVEX] and Peezy [PEEZY], with over 3,965% and over 2,158% increases, respectively.

Biggest losers

Dogwifhat [WIF]

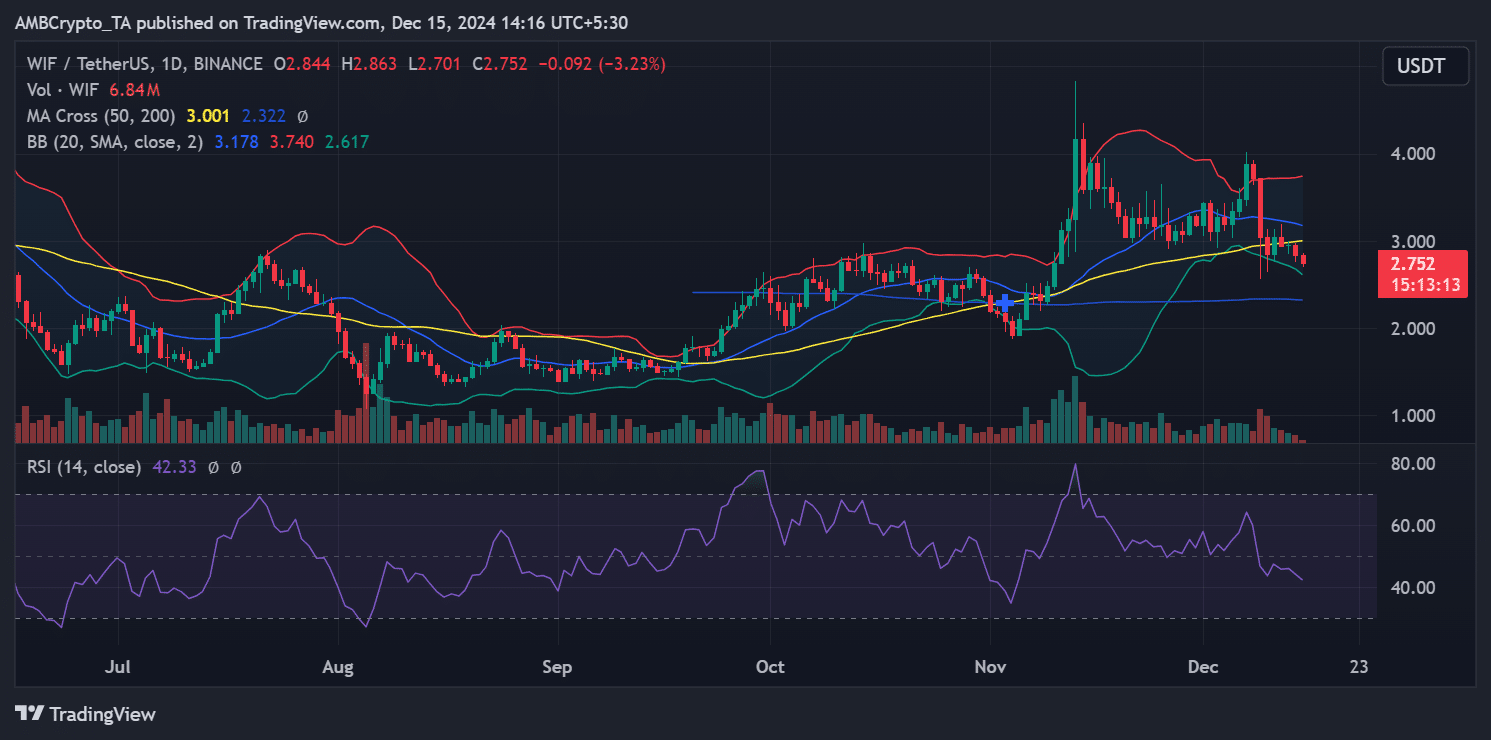

WIF emerged as the biggest loser of the past week, recording a 27.07% decline. The bearish momentum kicked off early, with a 4.18% drop on the first day of the week, dragging its price down to around $3.717.

This initial weakness was amplified on the 9th of December, when WIF saw a substantial 18% decline, plunging to the critical support level near $3.

Despite intermittent attempts to stabilize, selling pressure persisted throughout the week. By the end of the week, WIF closed at approximately $2.844, registering an additional 3% drop to cap off its underwhelming performance.

Furthermore, the price has dropped below the 50-day moving average (currently near $3.00), signaling a bearish trend reversal. The 200-day moving average at $2.32 is now the next critical support level.

Meanwhile, the Relative Strength Index (RSI) is hovering around 42.33, indicating that WIF is approaching oversold territory but is not yet primed for a significant reversal.

The Bollinger Bands suggest increased volatility, with WIF trading closer to the lower band, signaling persistent downward momentum.

If bearish forces continue, WIF could retest support at $2.50. A bounce back above $3.00 would be critical for any short-term recovery.

Brett [BRETT]

BRETT ranked as the second-biggest loser of the past week, posting a notable 23.79% decline.

The downtrend began on a muted note, with a minor 0.79% drop on the first day of the week, leaving the price hovering near $0.20.

However, selling pressure escalated sharply on the 9th of December, resulting in a steep 17.81% drop, dragging the price to a key support level around $0.17.

Despite brief stabilization attempts, bearish forces dominated the remainder of the week. By the week’s close, BRETT had slipped further to approximately $0.16, marking an additional 2.94% decline.

As of this writing, BRETT’s market capitalization was around $1.6 billion, with an over 8% decline.

Bonk [BONK]

BONK closed the week as the third-biggest loser, recording a substantial 23.32% decline. The bearish momentum started with a minor 1.40% drop, placing its price near $0.00004590.

However, like other memecoins, the token experienced a sharp correction of nearly 15% the next day, falling to approximately $0.00003902.

The selling pressure intensified, and by the week’s end, BONK had declined further, closing at $0.00003645 after a 6.15% drop.

Technical indicators paint a clear, bearish outlook. BONK’s price now trades below the 50-day moving average, signaling short-term weakness.

However, it remained above the 200-day moving average, hinting at potential long-term support. Volume data reveals significant selling activity, aligning with the downtrend.

Top 1,000 losers

Outside the top 100, this week’s top loser was HarryPotterObamaSonic10Inu 2.0 [BITCOIN], with an over 99.91% decline. The second and third biggest losers were trumpwifhat [TRUMP] and MICHI, with over 99% decline.

Conclusion

Here’s the weekly recap of the biggest gainers and losers. It’s crucial to bear in mind the volatile nature of the market, where prices can shift rapidly.

Thus, doing your own research (DYOR) before making investment decisions is best.

Source link