Blur NFT market trading volume surges 5X: Can BLUR token price rise too?

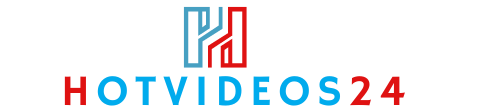

- Daily trading volume on Blur NFT market place was up 5x over the past month.

- Short traders get trapped as BLUR shows an uptrend bar amid recent overall market correction.

The daily trading volume on Blur [BLUR] NFT market place increased by more than 5X in November. This was the largest spike in volume, reaching and surpassing $35 million.

The surge corresponded with heightened activity suggesting growing interest in NFT platforms potentially influencing the price of the BLUR token.

Notably, the volume spikes were not consistent; instead, they appeared in sharp bursts, indicating reactive trading behavior.

If the trend of increased NFT activity continues, the price of BLUR could respond positively, mirroring the peaks in volume.

However, this could largely depend on the other conditions and the sustained interest in trading on Blur platform. This suggested BLUR was becoming a key player in NFT space, warranting close monitoring for future market reactions.

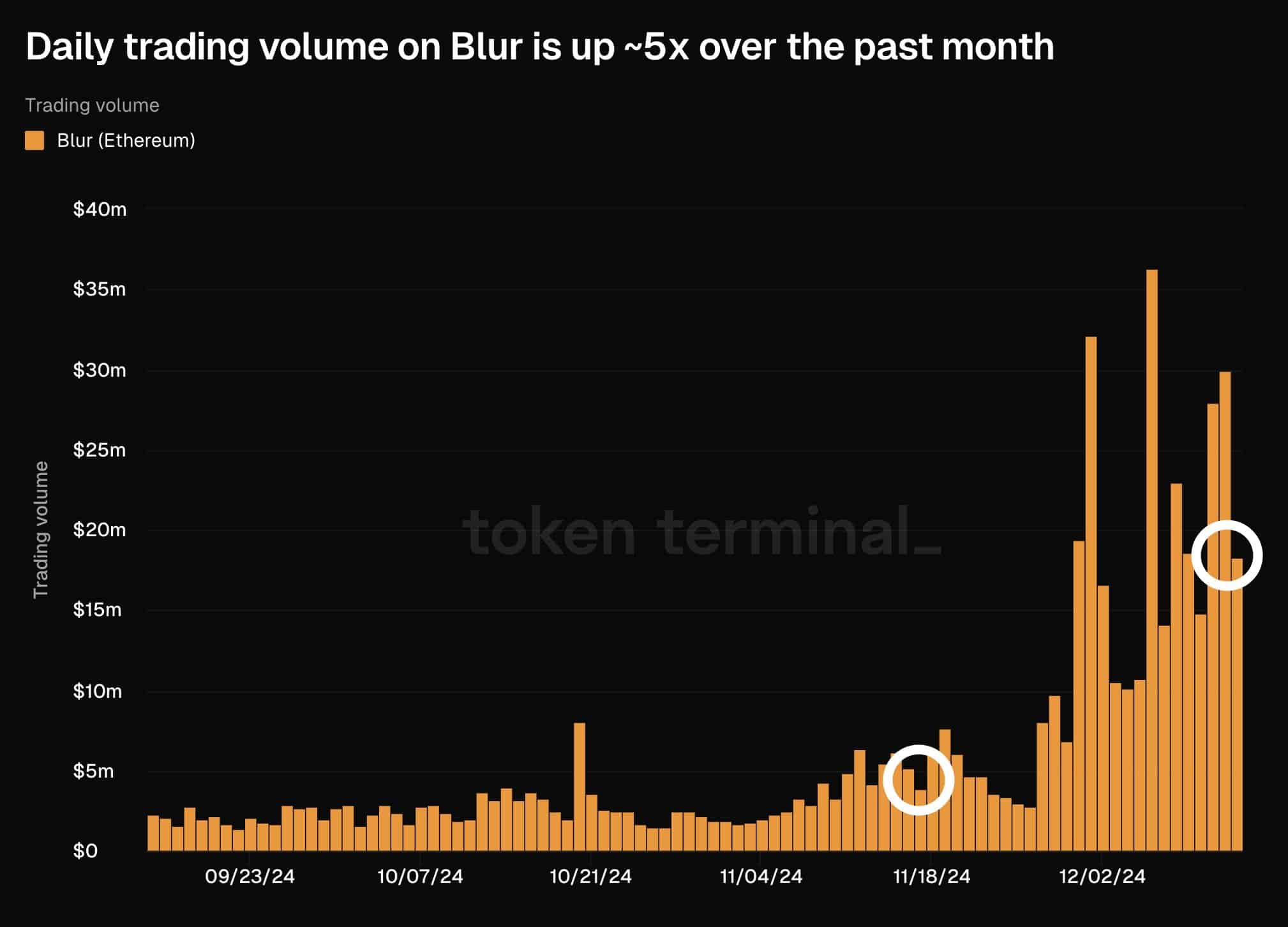

BLUR short traders trapped

BLUR’s short-selling activity over the past week caused an immediate spike in price, trapping shorts due to the quick rebound. This highlighted concentration of orders, signaling crowded short trades.

Subsequently, fresh shorts entered the market, only to find themselves trapped as the price escalated rapidly, reaching a peak around $0.44.

The trapped shorts indicated volatility and the risky nature of betting against a strong BLUR uptrend.

This activity indicated where shorts entered and their exit points, suggesting possible continuation if the trend of trapping shorts persists, leading to potential short squeezes that could further drive up prices.

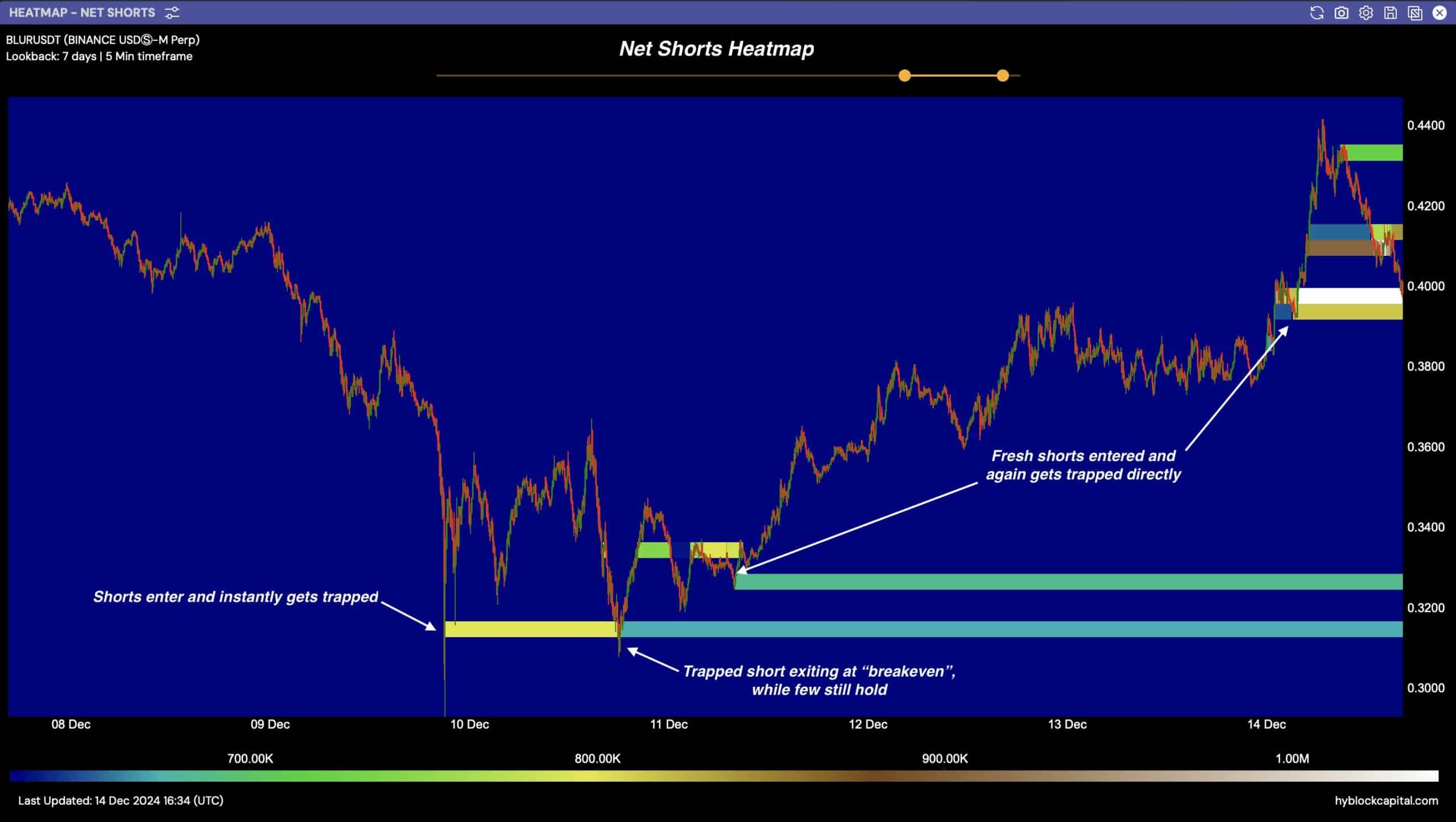

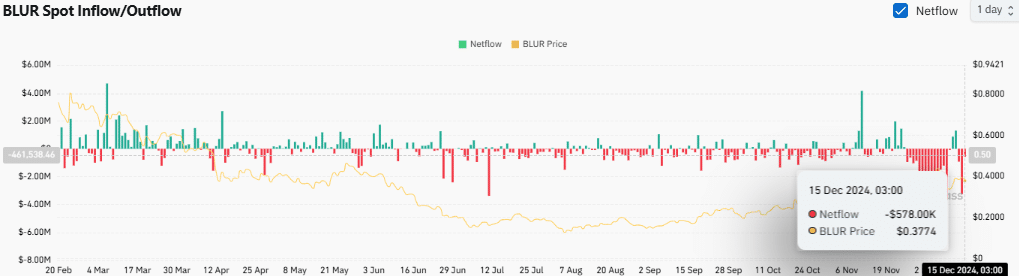

Prediction and spot inflow/outflow

BLUR responded to the ongoing resurgence in the NFT market, starting the month at $0.25 swiftly climbing near $0.45 by mid-December. This potentially attracted more traders.

This showed a bullish trend consistently staying above both the 50-day and 200-day SMAs, suggesting a strong upward momentum.

Additionally, the MACD being below the price, confirmed bullish sentiment as it remained in the positive throughout this period. The sharp uptick in MACD reinforced the bullish trend.

A sharp outflow of funds exceeding $6 million coincided with a spike in BLUR price, suggesting strong buying interest or withdrawal from exchanges.

Netflows remained relatively stable followed by a rapid outflow, indicating high volatility yearly.

The patterns suggested that the inflows and outflows were crucial. If the trend continues, BLUR could experience further price volatility, influenced by large transfers in and out of exchanges.

Source link